Stem Cells Market Size, Share & Industry Analysis, By Cell Type (Embryonic Stem Cells (ESCs), Mesenchymal Stem Cells (MSCs), Adult Stem Cells, and Induced Pluripotent Stem Cells (iPSCs)), By Application (Research and Clinical), By End-user (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

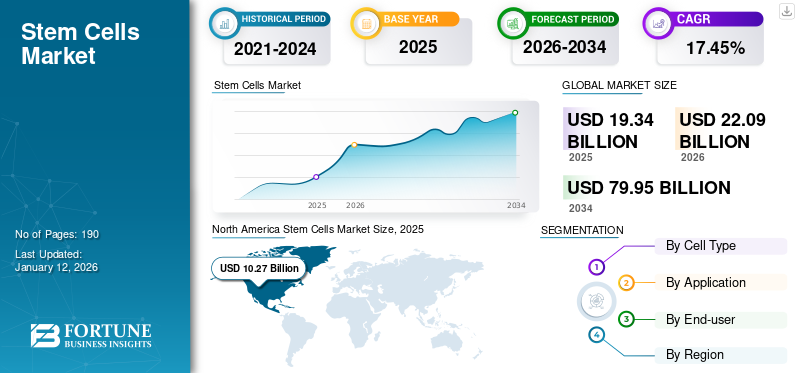

The global stem cells market size was valued at USD 19.34 billion in 2025. The market is projected to grow from USD 22.09

billion in 2026 to USD 79.95 billion by 2034, exhibiting a CAGR of 17.45% during the forecast period. North america dominated the stem cells market with a market share of 53.10% in 2025.

Stem cells have the ability to develop into specialized cells in the body. Stem cell therapy is an emerging treatment option for several diseases. It is witnessing widespread adoption in terms of research and clinical applications globally. The registration of clinical trials has been increasing at a significant rate annually to meet the increasing demand for novel medicines due to the rising prevalence of chronic diseases. Surge in the number of clinical trials owing to increase in research initiatives in the pharmaceutical sector are the key factors driving the global stem cells market growth. The clinical trials involving human pluripotent stem cells have increased in the last several years.

- According to the data published by the U.S. National Institutes of Health (NIH) in September 2022, 90 clinical trials had been registered in 13 countries with more than 3000 participants in 2021. However, only the U.S., Japan, China, and the U.K. conducted human embryonic and induced pluripotent stem cell-based trials. Moreover, the U.S., China, and Japan had listed 78% (70 out of 90) of all trials across the world.

Researchers and clinicians in the market are involved in developing innovative stem cell-based products that support healing & repair function, and improve patients' quality of life. In addition, the widespread applications of stem cell products and their higher adoption for therapies globally are attracting market players to set up manufacturing facilities. This factor is positively influencing the global market growth.

The COVID-19 outbreak positively impacted the growth of the global market. The application of stem cell products in treating the novel Coronavirus had boosted its demand, resulting in an increase in clinical trials. However, in 2021, the market witnessed sluggish growth owing to the delay in clinical trials and challenges associated with stem cell products. Nevertheless, the market is projected to record a rapid CAGR over the forecast period due to the growth in investments and strong product pipelines.

Stem Cells Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 19.34 billion

- 2026 Market Size: USD 22.09 billion

- 2034 Forecast Market Size: USD 79.95 billion

- CAGR: 17.45% from 2026–2034

Market Share:

- North America dominated the stem cells market with a 53.10% share in 2025, driven by robust R&D investments, favorable regulatory support, increased clinical trial activity, and high adoption of stem cell-based therapies across the U.S. and Canada.

- By cell type, Mesenchymal Stem Cells (MSCs) held the largest market share in 2024 due to their high demand in regenerative medicine and strong research potential. The iPSCs (induced pluripotent stem cells) segment is projected to register the fastest CAGR, owing to ethical advantages over ESCs, expanding applications in disease modeling, and rising investments in iPSC-based technologies.

Key Country Highlights:

- Japan: A key leader in stem cell R&D and one of the few countries conducting clinical trials using both embryonic and induced pluripotent stem cells. Government-backed initiatives and academic-industrial collaborations are driving adoption.

- United States: Dominates global clinical trials in stem cell therapy; NIH funding, academic partnerships, and initiatives such as UCSF–Thermo Fisher collaborations are propelling innovation and commercialization.

- China: Significant contributor to global clinical trials (alongside the U.S. and Japan). Rapid expansion in regenerative medicine infrastructure and strong government investment are fueling market growth.

- Europe: Witnessing steady growth with increasing regulatory clarity and funding for rare disease therapies. Countries like Germany and the U.K. are leading stem cell research and product development through partnerships and grants.

Stem Cells Market Trends

Emergence of iPSCs as Alternative to ESCs to Drive Market Growth

The induced Pluripotent Stem Cell (iPSC) technology has made enormous progress in stem cell biology and regenerative medicine. iPSCs are cells derived from adult somatic cells and are further reprogrammed to obtain the pluripotency of ESCs (Embryonic Stem Cells). The ESCs' derivation involves destroying an embryo at the blastocyte stage, which has created ethical concerns. However, iPSCs involve only the genetic reprogramming of somatic cells, hence they are away from the ethical issue of destroying human embryos in research. This has driven the market growth and increased the applications of this technology, such as disease modeling, drug discovery, and cell therapy development.

- For instance, in June 2023, FUJIFILM Cellular Dynamics, a manufacturer of human iPSCs, announced the launch of its human iPSC-derived iCell Blood-Brain Barrier Isogenic Kit for scientists involved in drug discovery for neuroactive drugs. The kit has barrier integrity and can advance drug discovery, development, and medical research for Central Nervous System (CNS) disorders.

Furthermore, human iPSCs are a highly preferred option due to the elimination of animal models and fewer ethical implications associated with these products. The iPSC segment is experiencing rapid growth in the market owing to increased demand for vaccines, growing application portfolio through continuous R&D activities, and rising investments in the sector.

- For instance, in a research study published by the National Center for Biotechnology Information (NCBI) in April 2023, researchers confirmed the strong trend of studies using human induced PSCs (iPSCs). This trend has become more significant since the past few years. The same source further stated that, in 2019-2020, the number of iPSC-based studies was 25, and in 2021-2022, this number was calculated to be 23.

Download Free sample to learn more about this report.

Stem Cells Market Growth Factors

Expanding Applications in Research and Therapeutics to Augment Market Growth

Stem cell products have diverse application areas, including research and development of novel therapies, such as regenerative medicine. Regenerative medicine is one of medical science's most recent branches. It helps in the restoration of normal functions in patients suffering from chronic diseases or severe injuries. Stem cells are gaining significant attention and adoption among researchers, scientists, and clinicians for the development of innovative therapies for various diseases as they are a promising cell source.

- For instance, a research study published in JACC Journals in March 2023 demonstrated the potential of Mesenchymal Precursor Cells (MPCs) in addressing chronic heart failure due to low Ejection Fraction (EF). This was one of the largest clinical trials conducted for this indication.

Furthermore, several factors, such as increasing acquisition & partnership agreements between key players and robust government funding to create novel solutions from these products are projected to drive the market growth over the forecast period.

- For instance, in July 2022, Bio-Techne acquired Namocell, a U.S.-based company offering consumables and instruments required for cell and gene therapy development, cell engineering, cell line development, single-cell genomics, antibody discovery, synthetic biology, and rare cell isolation.

Furthermore, the increasing incidence of diseases, such as neurological disorders, diabetes, and cancer, and growing government funding to accelerate research on these products are anticipated to drive market growth.

Focus of Key Players on Collaborations and Partnerships to Foster Research Activities Will Spur Market Growth

Recently, pharmaceutical companies have shown increased interest in stem cell products. The need for novel and better stem cell-based therapies for cardiac, autoimmune, and neurological disorders has resulted in an overall increase in the R&D activities of this market. The rising collaborations and partnerships between pharmaceutical and biotechnological companies are expected to boost stem cell research and treatment across the globe significantly.

- For instance, in July 2023, Pluristyx, Inc. announced its partnership with Stem Genomics. This partnership will evaluate the genomic stability of Pluristyx’s Pluripotent Stem Cell (PSC) lines using Stem Genomics’ iCS-digital PSC assay.

- Similarly, in July 2023, Cordlife Hong Kong Limited (Cordlife) and Hong Kong Regen MedTech Limited (HKRM), the partner companies of Hong Kong Science and Technology Parks Corporation (HKSTP), signed a collaboration agreement to enhance stem cell therapy. The companies aimed to co-launch a Mesenchymal Stem Cells (MSCs)-focused medical project.

Moreover, companies are also expanding their focus on increasing their product portfolio related to iPSCs due to their benefits in treating various diseases, which in turn, is projected to drive the growth of the global market over the forecast period.

RESTRAINING FACTORS

Ethical Concerns and Regulatory Complications Related to Stem Cell Research to Stifle Market Growth

Stem cell research offers great promise and hope for new treatments of diseases, such as spinal cord injury, diabetes, Parkinson's disease, and myocardial infarction. However, many obstacles and ethical controversies are associated with stem cell research. Human embryonic Stem Cell (hESC) research is ethically controversial as it involves the destruction of human embryos to create cell lines. In addition, arguments about the federal funding guidelines for research in human embryonic-based products and issues regarding the scientific purity, safety, and adequacy of consent of human embryonic stem cell lines are some of the factors hampering market growth. Moreover, serious bacterial infections were noticed with non-Food and Drug Administration (FDA)-approved umbilical cord blood-derived stem cell products.

- For instance, according to the data published by the California Department of Public Health in March 2019, infections were reported in persons who received the ReGen Series produced by Genentech, Inc. and distributed by Liveyon, LLC, as well as other non-FDA-approved umbilical cord blood-derived stem cell products.

Such health concerns and regulatory complications might hamper the growth of the market to a certain extent.

Stem Cells Market Segmentation Analysis

By Cell Type Analysis

Mesenchymal Stem Cells (MSCs) Segment Dominates owing to the Robust Demand for MSCs in Research Activities

Based on cell type, the market is segmented into Mesenchymal Stem Cells (MSCs), Embryonic Stem Cells (ESCs), Adult Stem Cells (ASCs), and induced Pluripotent Stem Cells (iPSCs).

The Mesenchymal Stem Cells (MSCs) segment held a dominant global market share in 2024. The segment’s growth is due to the robust demand for MSCs in research activities to create promising regenerative and stem cell-based therapies. The high secretion profile and self-renewal ability of MSCs are highly valued in the research communities for angiogenesis, skin tissues, and skeletal tissue regeneration research. This factor is boosting the demand for MSCs in the global market.

- For instance, in May 2023, Regenerative Labs started a prospective study using Wharton's jelly tissue allografts for Temporomandibular disorder (TMD). Wharton's jelly is a gelatinous connective tissue in the umbilical cord, and is an abundant source of mesenchymal stem cells.

Furthermore, the iPSCs segment accounted for the second-highest market share in 2024 and is projected to record the fastest CAGR. Rapid developments in iPSCs to boost the joint activities in basic and translational research to develop potential disease models and therapies will augment the segment’s growth.

On the other hand, Embryonic Stem Cells (ESCs) were the commonly used cell types in research studies. For instance, in a research study published in the National Center for Biotechnology Information (NCBI) in April 2023, researchers stated that human Embryonic Stem Cells (ESCs) accounted for a significant portion of research studies.

By Application Analysis

Research Segment Leads Owing to Growing Applications of Stem Cells as Potential Cure

Based on application, the market is bifurcated into research and clinical. The research segment held a dominant share of the global market in 2024. Globally, research activities utilizing stem cells as a potential cure are increasing. Also, the need for organoid and disease models using these cells is growing to understand the development of various diseases. These factors can significantly boost the segment’s growth.

- For instance, in June 2023, the Weizmann Institute of Science published data on stem cell-based human embryo model generation to understand and develop new insights into the causes of congenital disabilities and genetic disorders. Such developments will boost the research segment’s growth during the forecast period.

Moreover, the clinical segment is anticipated to record the fastest CAGR over the forecast period. Promising developments in regenerative medicine for the treatment of damaged tissues, cancers, Alzheimer's disease, and rare diseases will substantially increase the stem cell culturing processes across the globe. The increased need for large batches of stem cells for therapeutic purposes is anticipated to fuel the segment growth during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Pharmaceutical & Biotechnology Segment Accounts for the Highest Market Share Owing to the Extensive Ongoing Clinical Studies

Based on end-user, the market is segmented into hospitals, pharmaceutical & biotechnology companies, academic & research institutes, and others.

The pharmaceutical & biotechnology companies segment captured the largest stem cells market share in 2024. Extensive clinical studies conducted across the globe for the development of stem cell therapies to treat chronic and rare diseases and a notable shift from embryonic stem cell lines to induced pluripotent stem cells for research activities are factors increasing the demand for stem cell culturing products in the pharmaceutical & biotechnology industry.

- For instance, in August 2023, Cynata Therapeutics initiated a phase 2 clinical trial for an iPSC-derived Cymerus Mesenchymal Stem Cell (MSC) product to treat steroid-resistant acute graft-versus-host diseases. Thus, clinical studies across the globe will increase the use of reagents and stem cells, thereby propelling the segment’s growth.

The academic & research institutes segment is estimated to account for the highest CAGR during the forecast period. Growing demand and development of cures for various diseases will boost industry-academic collaborations. Also, investments by major players in academic & research institutes will accelerate the segment’s growth. Besides, rising initiatives by government bodies are also expected to drive the segment’s progress during the forecast period.

REGIONAL INSIGHTS

The market is analyzed across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Stem Cells Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America market size was valued at USD 10.27 billion in 2025. The region accounted for the largest market share due to its huge volume of research and development activities, rising approvals for stem cell therapies, and advanced product launches across the region.

- For instance, in May 2023, the Maryland Stem Cell Research (MSCRF) Commission announced over USD 14.1 million in funding to promote innovative research to advance and strengthen stem cell treatments and technologies in Maryland, U.S.

In addition, Europe is projected to record a significant growth rate over the forecast period owing to rising investments in R&D activities by leading companies to treat rare diseases.

The Latin America and the Middle East & Africa regions accounted for a comparatively lower share of the market in 2024 due to the less penetration of stem cell therapy research in these regions. The UK market is projected to reach USD 0.88 billion by 2026. The Germany market is projected to reach USD 0.97 billion by 2026.

Asia Pacific is expected to register the highest CAGR over the forecast period. Rapid industrial growth, increasing number of clinical trials, advanced biomedicine infrastructure, presence of skilled professionals for stem cell treatment, and increasing investments in this field are expected to drive market growth in the region. The Japan market is projected to reach USD 1.10 billion by 2026. The China market is projected to reach USD 1.86 billion by 2026. The India market is projected to reach USD 0.61 billion by 2026.

Key Industry Players

Thermo Fisher Scientific, Merck KGaA, STEMCELL Technologies, and Miltenyi Biotec B.V. & Co. KG to Lead Market Growth

Thermo Fisher Scientific, Merck KGaA, STEMCELL Technologies, and Miltenyi Biotec B.V. & Co. are dominating the market. These companies are focusing on increasing production and expanding their product offerings for stem cell culturing and cell therapy through acquisitions and collaborations.

- For instance, in March 2023, Thermo Fisher Scientific Inc. opened its cell therapy plant in collaboration with the University of California, San Francisco (UCSF) at the UCSF complex.

Furthermore, companies, such as Bio-Techne, AcceGen, and Lonza are undertaking various initiatives, such as new product launches and acquisitions to strengthen their market presence. Other market players include Cellular Engineering Technologies, PromoCell GmbH, and MEDIPOST Co. Most of these companies are small & mid-sized, thus have a comparatively lower share and product offerings in the market.

List of Top Stem Cells Companies:

- PromoCell GmbH (Germany)

- AcceGen (U.S.)

- Bio-Techne (U.S.)

- Cellular Engineering Technologies (U.S.)

- Merck KgaA (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Lonza (Switzerland)

- Miltenyi Biotec B.V. & Co. KG (Germany)

- STEMCELL Technologies (Canada)

KEY INDUSTRY DEVELOPMENTS:

- December 2023 - GenCure and the University of Texas at San Antonio (UTSA) collaborated to develop cellular therapy products, services, and testing.

- August 2023 - BlueRock Therapeutics LP and bit.bio signed an agreement for the discovery, development, and manufacturing of iPSC-derived regulatory T cells (Tregs) which can be used for therapeutic purposes.

- July 2023 - PromoCell GmbH launched the PromoExQ MSC Growth Medium XF for in-vitro expansion of human Mesenchymal Stem Cells (hMSCs) in a regulated environment to consistently grow and maintain multipotent hMSCs.

- July 2023 - Pluristyx, Inc. partnered with Stem Genomics. This partnership will evaluate the genomic stability of Pluristyx’s Pluripotent Stem Cell (PSC) lines using Stem Genomics’ iCS-digital PSC assay.

- June 2023 - FUJIFILM Cellular Dynamics, a manufacturer of human induced Pluripotent Stem Cells (iPSCs), announced the launch of its human iPSC-derived iCell Blood-Brain Barrier Isogenic Kit for scientists involved in drug discovery for neuroactive medicines. The kit has barrier integrity and can advance drug discovery, development, and medical research for Central Nervous System (CNS) disorders.

- June 2023 - Lonza collaborated with Vertex Pharmaceuticals Incorporated to produce stem cell-derived, fully differentiated insulin-producing islet cell therapy for Type 1 Diabetes patients. The therapy is under investigation by Vertex Pharmaceuticals.

- May 2023 - ScaleReady USA, a joint venture of Bio-Techne, collaborated with Cellular Origins. Through the collaboration, ScaleReady USA will automate the cell and gene therapy manufacturing processes using a cellular-based robotic system.

REPORT COVERAGE

The report offers a detailed analysis and overview of the market. It focuses on key aspects, such as competitive landscape, leading cell types, applications, end-users, and regions. Moreover, it offers insights into the market drivers, trends, dynamics, and other key insights. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

|

|

Base Year |

|

|

Forecast Period |

2026-2034 |

|

Historical Period |

|

|

Growth Rate |

CAGR of 17.45% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Cell Type

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global stem cells market was valued at USD 19.34 billion in 2025 and is projected to reach USD 79.95 billion by 2034.

Registering a CAGR of 17.45%, the market will exhibit steady growth during the forecast period of 2026-2034.

Mesenchymal Stem Cells (MSCs) held the dominant market share in 2025 due to their self-renewal properties, widespread use in tissue regeneration, and increasing demand in research applications.

By cell type, the Mesenchymal Stem Cells (MSCs) segment is expected to be the leading segment in the market during the forecast period.

Rise in the number of clinical trials leading to innovative product launches and strong focus of key players on collaborations and partnerships are major factors driving the growth of the market.

Thermo Fisher Scientific, Merck KGaA, STEMCELL Technologies, and Miltenyi Biotec B.V. & Co. KG are major players in the global market.

North America dominated the market share in 2025.

Emergence of iPSCs as an alternative to ESCs (Embryonic Stem Cells) is a key trend in the market.

Key restraints include ethical concerns surrounding embryonic stem cell research, regulatory hurdles, and safety issues related to non-FDA-approved stem cell products, which may limit market adoption in certain regions.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us